Special Drawing Rights (SDR) represents a basket of 5 currencies with the highest international money circulation.

Special Drawing Rights (SDR) represents a basket of 5 currencies with the highest international money circulation.

These 5 currencies belong to the first 5 countries having the highest GDP (gross domestic product) in the world.

These countries have together 80% from the entire GDP of the world.

These currencies are:

1. US Dollar $

2. Euro €

3. Chinese Yuan ¥

4. Japanese Yen ¥

5. British Pound £

In this basket of 5 currencies (SDR) every currency has a certain share.

The share (percentage) is according to the level of participation of

each currency: on the Foreign Exchange Market, on the value of goods exported and traded in that currency and the value of the stock transactions that are denominated in that currency.

The share of every currency in the SDR, for 2016-2020, is:

US Dollar 41.73%

Euro 30.93%

Chinese Yuan 10.92%

Japanese Yen 8.33%

British Pound 8,09%

——————

Total 100%

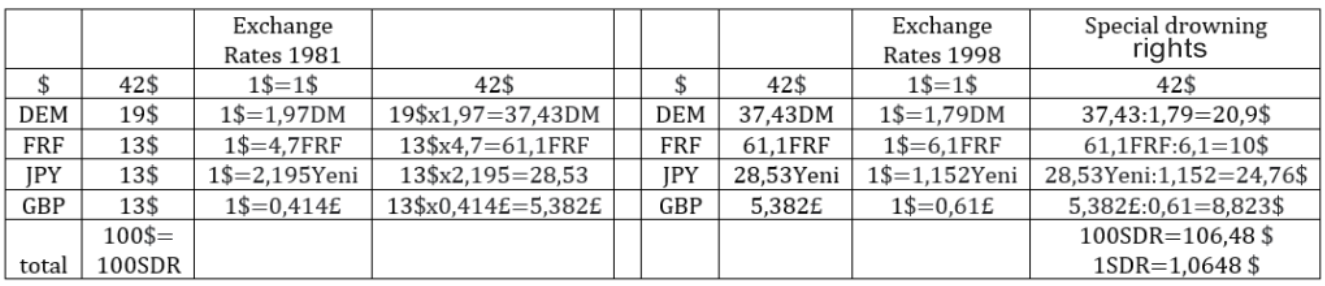

For the period 1981-1998, before the existence of Euro, Special Drawing Rights had the following structure:

US Dollar 42%

Deutsche Mark 19%

French Frank 13%

Japanese Yen 13%

British Pound 13%

——————

Total 100%

Initially, 1 SDR was equal with 1 USD.

In time, its value changes due to the exchange rates modifications between the dollar and the rest of 4 currencies that are part of SDR.

Bank of International Settlements (BIS) has a very important role in settling of the shares of each currency in SDR currency basket.

The commercial banks, the investment banks and other financial institutions that operate currency exchange, have to report to the local Central Bank every currency exchange done in the country every day.

The Central Bank of each state has the obligation, at its turn, to return all the foreign exchanges operated daily to the Bank of International Settlements (BIS) from Basel, Switzerland.

This way, the global centre that records all the international currency exchange is BIS.

BIS is also the place where the very big banks list the very big currency bids and asks.

Basically, BIS is the foreign exchange market.

Bank for International Settlements owns the data about the 5 big currencies.

BIS knows precisely the participation of each of the five currencies on the international trade, in the currency market and on the long term (10 – 30 years) bond market.

BIS communicates to the banks from the Global Iranian Financial Trust every 5 years the percentage corresponding to each currency from the SDR basket.

These percentages must be respected also in the long-term bond securitisation process. The securitisation is an operation of blending in the same contract of sales or purchase of the bonds belonging to the 5 states.

The bonds issued in the currency of each state participate on the securitisated product with the SDR corresponding percentage.

Example I:

This way, a financial securitisated contract (for instance 1981-1998) must contain:

American T-bonds 42%

German T-bonds 19%

French T-bonds 13%

Japanes T-bonds 13%

British T-bonds 13%

——————————

Total 100%

Example II:

A financial securitisated contract from 2016-2020 must contain;

American bonds 41.73%

Euro denominated European bonds 30.93%

Yuan denominated Chinese bonds 10,92%

Yen denominated Japanese bonds 8,33%

British pounds denominated British bonds 8,09%

——————————————

Total 100%

The percentages apply to the value of all the bonds from the securitisated bonds package transformed in USD at the exchange rate available at the date of issuing of the securitisated product.

BIS communicates to the Investment Banks of the Iranian Global Finance Trust what percentage from their bonds portfolio to be allocated to each of the 5 countries (with their corresponding 5 currencies).

Due to the foreign exchange fluctuation, there is a risk of lower yield at the expiry date than the foreign exchange loss. By securitisation (the portfolio diversification in the 5 currencies), the foreign exchange currency risk is eliminated.

Whatever the dollar losses, the other currencies from the basket gains.

If the pound and yen go up, the other three go down.

The SDR fluctuates twice less than the dollar, on the long term.

SDR is the most stable currency of all.

SDR is, in fact, a global currency used since antiquity. The most powerful 5 empires’ currencies have always formed the SDR of that time.

Across the centuries, an empire (its currency) exits the SDR and another one comes in.

The stability example of the SDR between 1981 – 1998:

See the next table:

Observations:

Because the Yen has no cents as currency subdivision, one can divide to 100 and get a currency unit a hundred times higher than the Yen. This way, 1 USD no longer values (in `1998) 115,2 small yens, but it will worth 1,152 big Yens, meaning 1 USD = 1,152 big Yen.

The new Yen (big) has now monetary unit subdivisions that is the Yen cent (the Yen cent is the initial Yen, the small Yen).

Observations:

In the 18 years (from 1981 to 1998), the SDR basket currencies have gained or lost against the US dollar.

DM 1,97 ↗ 1,79 gained 10%

FRF 4,7 ↘ 6,1 French Franc lost 25%

Jp Yen 2,195 ↗ 1,152 Yen/ $ almost doubled its value

GBP 0,414 ↘ 0,61 £/ $ lost 32%

Despite all these high variations, Special Drawing Rights varied only + 6,48%.

1 SDR = 1,0648 USD

During all this time, if the banks have invested only in British bonds, whose currency value lost 32%, that bank would be bankrupted.

Moreover, SDR is the only currency with the most stabile value against gold.

The gold is valued in USD/troy once on the London market.

If $ is weakened by Tehran for specific purposes then the price of gold has to be raised in the same day on the gold market in order not to lose its value on the market.

If the dollar loses value with a certain percentage, the price of gold has to be increased with only half of this percentage, meaning only with the SDR variation. (as we have mentioned before, the SDR variation is about half of the dollar variation).

The price of gold is artificially kept as much as possible steady in SDR by the (faked) daily fixing by the companies:

1) Mocatta & Goldsmid

2) NM Rothschild & Sons

3) Sharps Pixley Ltd

4) Samuel Montague

5) Jonson Mathey Bankers

These companies form the London Gold Market

======================================================

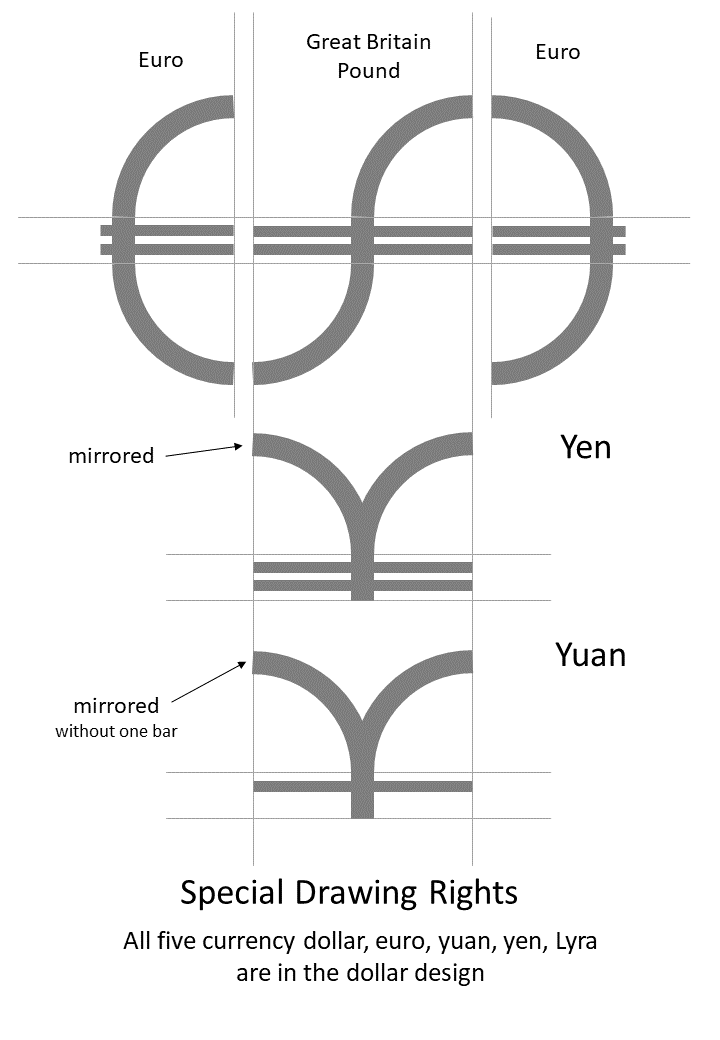

As one can observe in the next figure, the dollar design contains the drowings of the other 4 currencies from the SDR:

Euro, British pound, Japonese Yen and Chinese Yuan.

The shape of the Yen is obtained from the design of Brithis pound to which the low part is moved up by mirroring against the horizontal median lines of the pound.

The shape of the Yuoan is obtained from the shape of the Yen from which one horizontal line has been eliminated.

0 Comments