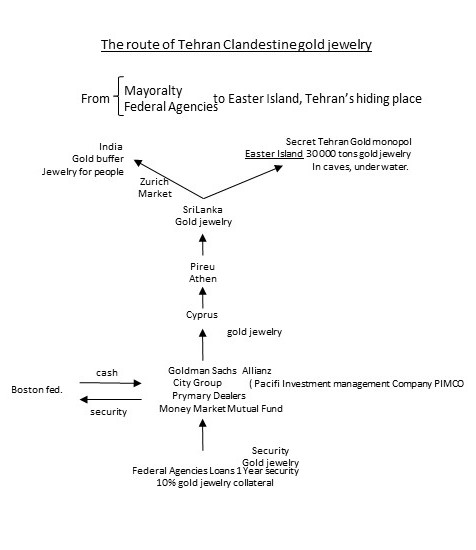

According to the international bank regulation, the creditors of the state take 10% warranty collateral in gold reported to the loans longer than one year. For the central treasury credits, the gold has to be fine: 999,9/ 1000 purity.

For the loans given to the mayoralty and federal agencies, the collateral can be gold jewelleries 10% of the credit value:

a. For the credit exceeding one year, the regulation stipulates a 10% gold collateral from the value of the credit.

b. For the credits below one year is stipulated is no need for a collateral in gold.

c. For the credits of one year the law does not stipulate anything.

Primary dealers lend money to the federal agencies for one year. For this credit, they take in custody a collateral of 10% from the credit value in massive gold jewelleries.

If the primary dealer Goldman Sachs (Iranian company) wishes to get into the possession of the funds before the expiry of the federal agencies’ securities, they can borrow money from Boston Fed, leaving only the securities as collateral but not the gold.

The Boston fed considers legally that the loan does not exceed one year, therefore there is no need for gold as collateral in custody:

This way, by an occult participation of the law makers, the Boston Federal Reserve and the Federal Agencies,-the gold stays in the possession of the primary dealer (M.M.M. fund) Goldman Sachs. This is a secret operation.

Because the one-year credits are roll-over before the expiry date, in their vast majority, the gold left as collateral stays forever in the custody of Goldman Sachs MMM fund.

The world countries have a big part of their credits of one-year Tnote.

One part of them is issued by the city mayoralties or by the federal agencies. This results in a huge quantity of clandestine gold in jewelries whose trace has been lost.

This clandestine gold is in Tehran possession through companies Goldman Sachs and Citi Group.

The golden jewelleries are not considered as foreign currency, therefore is not registered in the Bank of International Settlements (BIS) records (from Basel, Switzerland).

B.I.S. is in the secret property of Tehran and is coordinated by Tehran.

For the credits issued for the state’s treasuries, the 10% collateral is available in standard ingots (fine gold: 999,9/ 1000) 24K.

These are correctly regulated by law and is considered as a foreign currency and cannot follow a clandestine path.

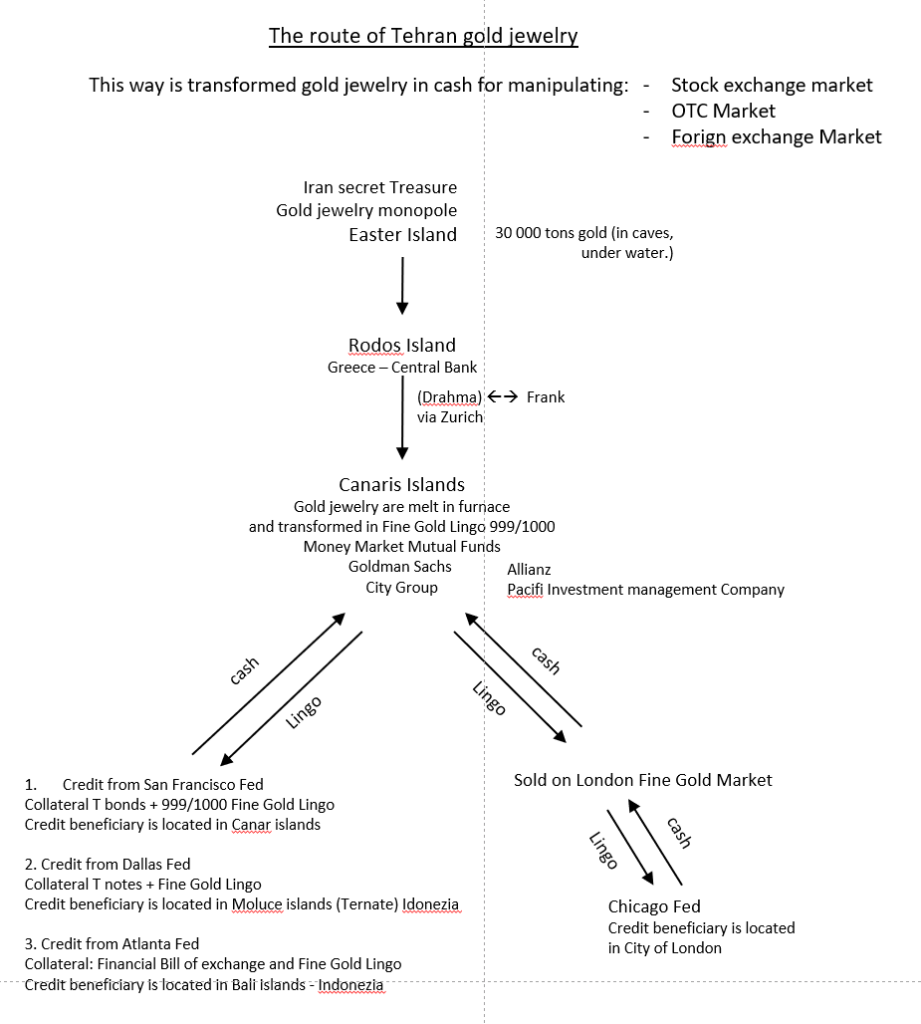

The golden jewelleries that get in Iran’s possession secretly and clandestine through the companies Goldman Sachs and Citi Group is hidden (stored) as follows:

A. One part is hidden in submersed caves in Easter Island. There, there are 30.000 tons of average purity 666 points (equivalent of 16K) gold. The biggest quantity of golden jewelleries is 14K (583,3 points) and 18K (750 points) with an average of 666 points. This is the gold monopoly of Iran’s Ayatollah (Shah).

B. One part is in the form of jewelleries kept by the rich families in India, bought from the golden jewelleries market in Zurich.

Tehran can buy or sell gold jewelleries against rupees as much as needed.

C. One part is in Canary Islands (seven islands) in submersed caves. Here the gold is melted in special furnace and transformed from jewelleries into standard ingots (fine gold: 999,9/ 1000). These fine gold ingots that come from melted jewelleries have the following destinations:

1. They are sold through the London Gold Market to Chicago Fed and the cash is used to finance the speculators with a leverage type credit (1/ 20 ratio) on the stock exchange and 1/ 50 on the forex market.

With the same money, the Tehran companies Goldman Sachs and Citi Group speculate with derivative products on the “Over the counter” (O.T.C. market).

2. The gold is used as collateral together with securities in order to obtain a medium-term credit from Dallas Fed. This cash is used as leverage type lending for speculators that bet the opposite way from the ones from the previous paragraph (no. 1) on the stock exchange and forex market.

3. This fine gold is used by MMMF to obtain credit from Atlanta Fed. The cash is obtained by the discount of financial bills of exchange (bronze bills of exchange).

Together with these bills of exchange, the Atlanta Fed also requests fine standard gold collateral of 10% from the credit value.

The financial bills do not come from the industry like the commercial bills of exchange and are issued without any economic necessity by the companies J.P. Morgan, Morgan Stanley, Citi Group and other companies from Dow Jones index.

Basically, these companies print money through the Atlanta Fed for Iran, with zero interest rate, money they use to manipulate the opening price of the markets.

The opening price of the market is artificially created by market maker broker dealer, Citi Group in cooperation with J.P. Morgan, in a secret agreement with the sellers and buyers traders.

4. The gold is left as collateral together with securities to obtain medium term cash from San Francisco Fed.

The cash will enter the derivative products market and the OTC markets.

The sales or buying orders are done directly from Canary Islands.

The derivative products can be future contracts, options, structured products etc.

These transactions aim the price change of the support assets of these derivatives (and OTC products) at the desired price.

The course of the derivative products issued in the Canary Islands (derivative markets) are influenced by the Over-the-Counter financial products (that are not regulated) traded from Solomon Island.

From Solomon Island, all the OTC market is controlled and the products are known by the speculators as investing bets.

Iran has submitted the coordination of the OTC markets to India.

The support assets are all the assets traded in the stock exchange.

As a conclusion, the stock market process are not not free market prices, a result between bid and ask.

The prices are manipulated by that financial institutions that have access to the 12 Federal Reserve Banks.

See below the following figure showing the path of the golden jewelries of Tehran towards Easter Island and back to the financial system.

The cave with gold from The Easter Island

Tehran’s gold from the Easter Island is stored in a cave situated in the Easter side of the island right at Cape Roggewain.

The entrance is about 3 meters.

The entrance is covered by a concrete block.

The entrance opens by lifting the concrete block by pulling it with cables from the shore of the island.

The cables are actioned by a pulley machine place on the terrace of the island.

After the opening of the entrance, the gold is transported inside the cave with the help of fishing motor boats.

Up to the island, the gold is shipped from Cyprus via SriLanka with other ocean vessels or a Dolphin Class submarine.

After the entrance in the cave, a straight path is followed, a right turn is done and another one to the right.

The gold in the cave is submersed on the bottom of the cave in same cages controlled by ropes.

The depth of the water in the cave is about 10 meters.

The island was declared historic monument and therefore the access on the island is permitted by the authority of the State of Chile in order not to receive tourists.

The gold of Tehran from the Easter Island is massive gold in jewelries.

The purity of the gold is 14 Karat (583/1000) and 19 Karat (750/1000). The average purity of the gold is (583+750)/2 = 666 points (16 Karat = 666/1000).

The quantity of gold from the Easter Island is 30.000tons (thirty thousand tons).

0 Comments