I. The price manipulation at the stock market

Stock market opening price is manipulated by market maker broker dealer. In the pre-opening time (9.30-10), buying and selling orders are put in the market through the market maker broker dealer with no transaction being done yet.

Traders and speculators put in the market through the broker the following types of orders:

The sales traders:

-Selling order “to the market” price. This specifies the quantity of bonds but not the price. The price will be the one that a buyer will offer for the quantity of bonds.

-Selling order with minimum price limit. This specifies the quantity of bonds and the minimum price for the sale.

The buying traders:

-Buying order “to the market”. This order specifies of quantity of bonds that must be bought but not the price. The issue of the order accepts to buy bonds available for sale at the market price from the moment they put the order in.

-Buying order with maximum price limit. This specifies the quantity of bonds and the maximum price for the purchase.

-Market maker broker dealer – can introduce in the market his own orders, as follows:

-Selling orders – at the market

– with a minimum sales price

-Buying orders – at the market price

– with a maximum price buying limit

The stock market opening price is delivered to the broker by a secret messenger from Tehran every day.

The broker will manipulate this price through the orders he receives from the market participants and through the orders introduced by himself. The broker is in complicity with some specific sellers’ dealers and buyers’ dealers without the other market participants to know about this conspiration.

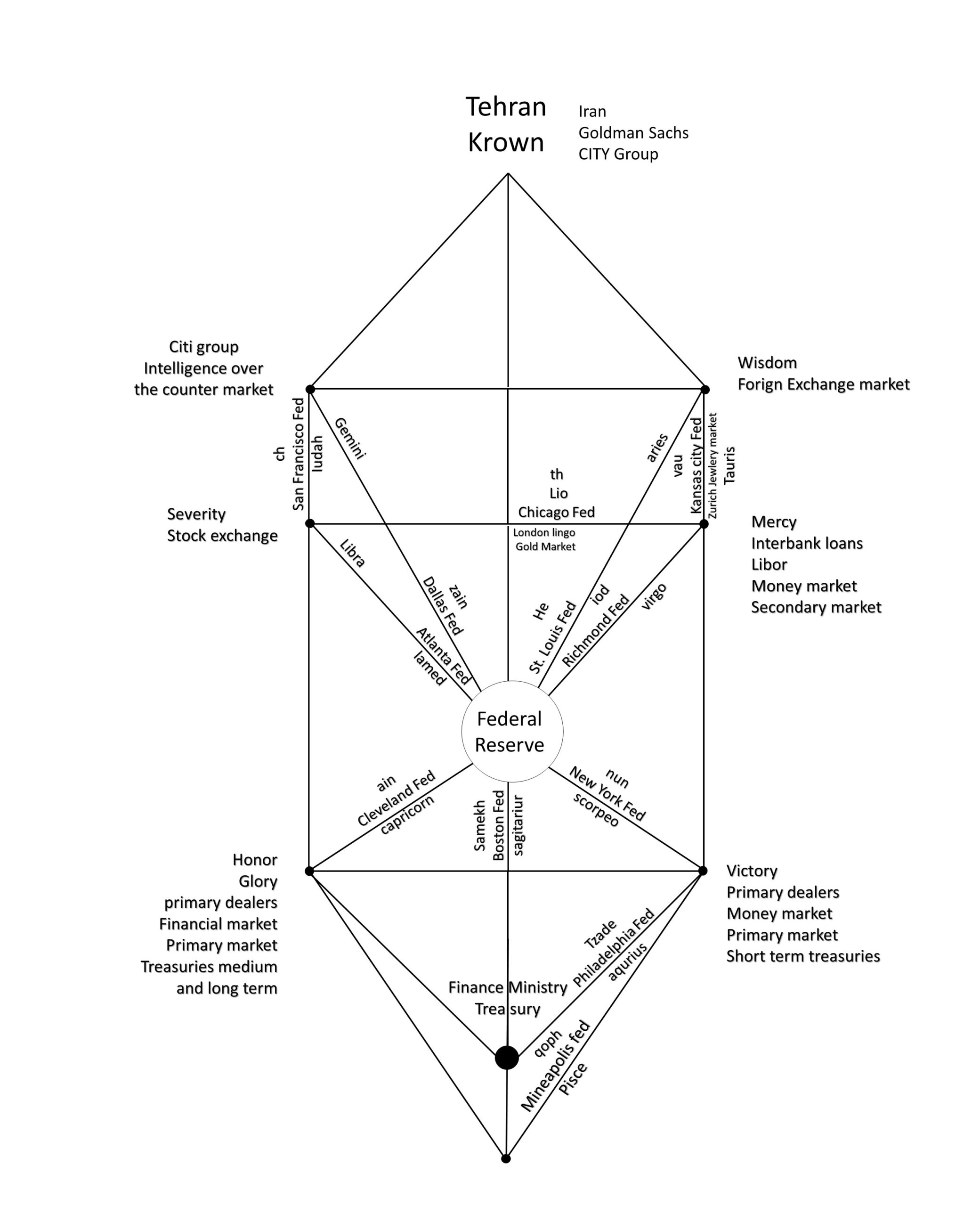

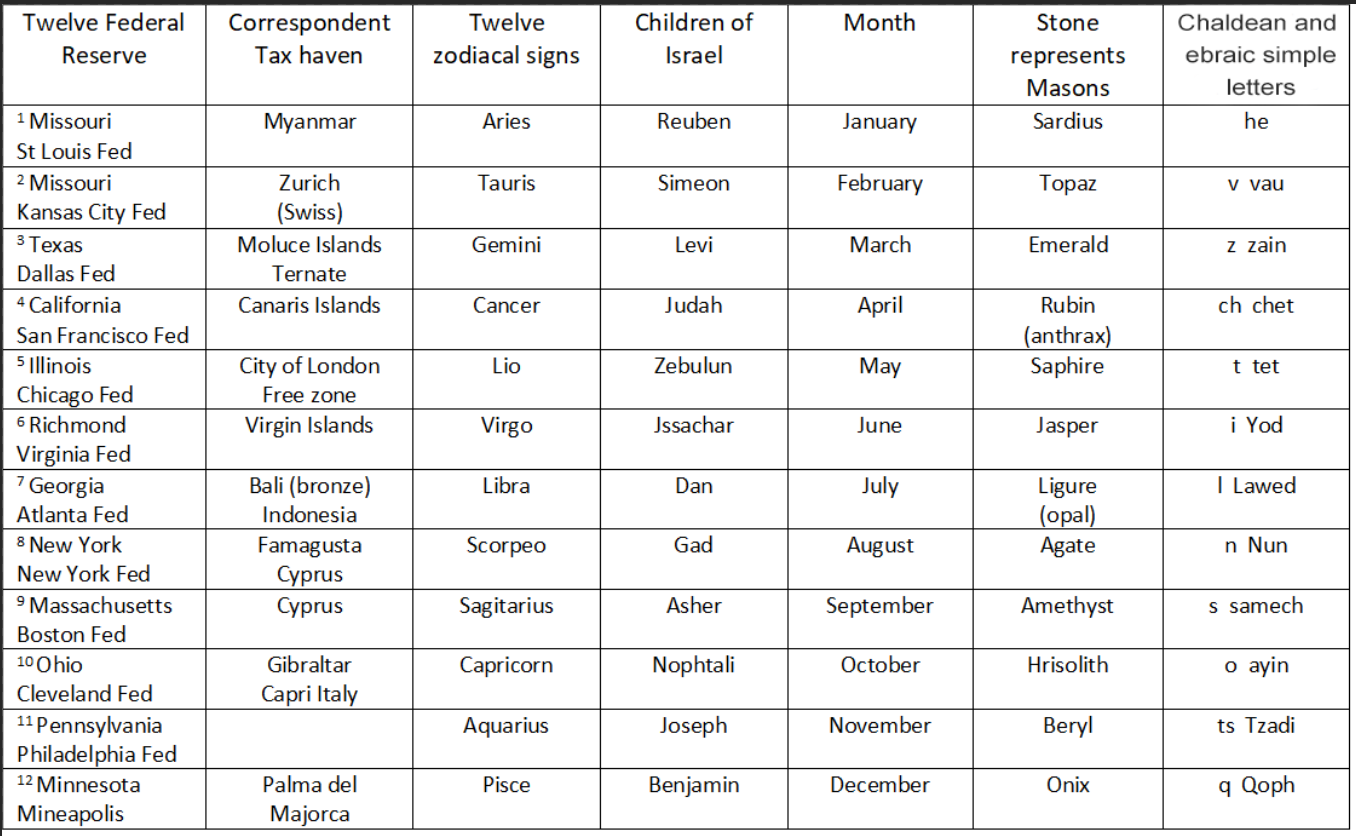

The companies involved in this secret complicity to create the artificial price of the stock market belong to financial holdings that have precise cooperation and subordination relations from the top to the base.

The financial holdings that belong to the financial secret global trust are:

1. Goldman Sachs

2 Citi Group

3. AIG (American International Group)

4. J.P. Morgan Chase

5. Merrill Lynch

6. Bank of America

7. Washington Mutual

8. Wachovia

9. Bearn Stearns

10. Wells Fargo

11. Morgan Stanley

12. Chase Manhattan

Each of these financial holding companies are made by:

1. Commercial bank

2. Investment bank

3. Insurance company

4. Private equity fund

5. Broker dealer

6. Proprietary trader (Market Maker)

7. Hedge fund

8. Money market mutual fund

9. Asset manager

—-V——————————-

*For instance, Financial Holding Company Goldman Sachs

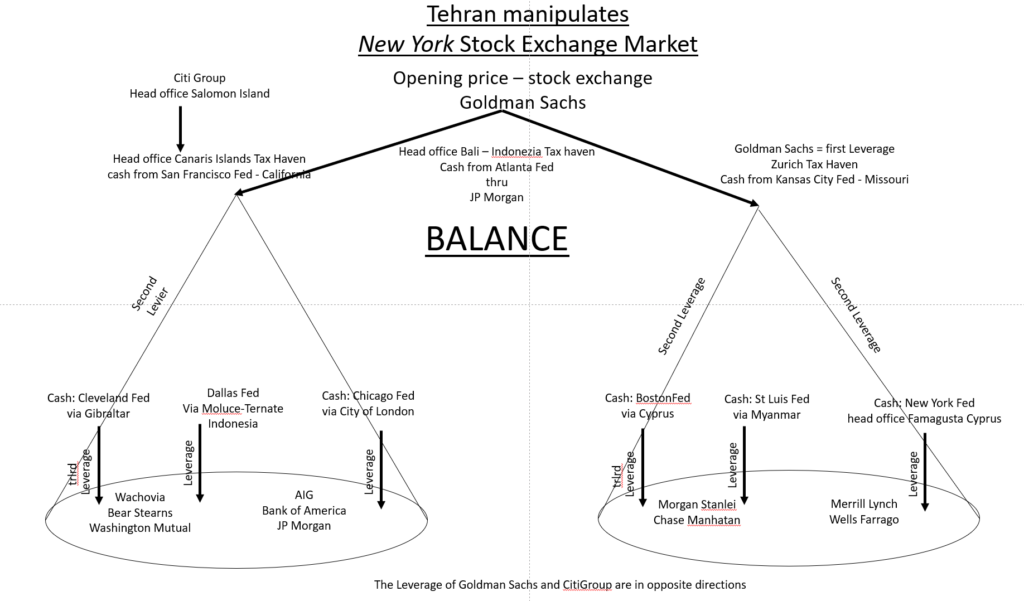

These holdings are coordinated from Tehran. The strategies used by market maker broker dealer to push the opening price of a bond to the value imposed from Tehran.

1. Introduces sales order in his own name if there is a big request in the market with no offers.

2. If the bond offers at a certain price are not covered with buying orders, it introduces his own buying orders at the market or with maximum price limit.

3. The market orders “at the market” are the most important because they do not have a fixed price. They have priority in the market and they allow a big flexibility to artificially drive the equilibrium course to the wished value.

Being no price written on the order, it allows the broker to find a transaction (settlement) at the price he wishes.

4. He introduces in the market maximum limit price buying orders close to the targeted value.

5. He introduces in the market an appropriate minimum limit selling orders, in order to find transaction close to the targeted price.

6. It can receive sales orders or buying orders with no price specification (blank) from the traders they are in complicity with. The broker will fill these orders from sellers or buyers bond traders (in complicity) without the former to contest (to put any claim). On the blank orders, the broker will write the prices and the quantities of bonds that lead to a transaction at the targeted price.

7. The broker can modify the orders received from the traders in the market they have an agreement with. The modification is done on the quantity and the price of the bonds. No accomplice will put any claim related to the modification of the order. Even in many situations they sell or buy on a loss.

8. The broker can decide not to put in the market the orders given by partner traders if they consider the orders do not lead to the targeted opening price.

9. The broker can indicate the dealers the price they have to write on the order by writing the value on a note without the other traders to see it. In the Middle Eve, the broker was using mirrors to show to his partner what to write on the order.

10. The equilibrium opening price is set after the entry in the market (in the pre-opening time, during discontinuous market conditions) of all the offers to buy or to sell.

The stock market regulation statutes that equilibrium course is that course that allows trading of the biggest amount of bonds. The market regulation is done in Tehran and uses all the methods experienced from antiquity in order to manipulate the opening price.

The sales traders, buying traders, market maker broker dealer and the stock market company are all part of the secret Iranian Financial Trust. They have a large financial power compared to the other investors and individual speculators (that are not part of the conspiracy) that participate in the market. This way, the biggest amount of orders are put in the market at the prices dictated by these companies.

The stock market commissions that can be very expensive for this big amount of transactions are not relevant because the stock market makes profit and belongs to the same holding as the companies that pay the commissions.

In the same time, the market and brokers’ commissions are very expensive for the individual local speculators that are not part of the conspiracy. These speculators, in most of the cases, loose in the market.

This is the way the stock market artificial opening price is made for the bonds issued by a given state.

This type of transaction is called discontinuous market.

The “market maker broker dealer” company is part of the same financial holding with a “primary dealer” that lent money to the given state on the primary market.

These have in their portfolio important amounts of bonds and big amounts of cash at their disposal.

The market maker broker dealer receives cash from Atlanta Fed – Georgia against financial cambia (bronze financial bills of exchange) and a 10% fine gold (999,9/ 1000) ingots.

The market maker broker dealers’ office is in tax heaven Bali, Indonesia.

II. The opening of the market

The role of the opening price over the trading price in the market, during the day

After the opening of the market after 10.15 AM, it runs in a continuous way (continuous market).

The system imposed by the Tehran financial sect for the price manipulation after the opening of the market is the following:

Market “maker broker dealer” together with the sellers traders and buyers traders involved in a secret conspiracy against the respective state (the state of which long term bonds are traded0 bring the value of the principle of the bonds at a targeted price.

The other participants at the trading are Iranian secret agents (homosexuals, black mailed and co-interested).

They have the following strategy to obtain the target price:

1. To introduce in the market:

a. Buying orders with 8% maximum price limit more than the opening price of that day.

b. Sales orders with minimum price limit 8% lower than the opening price of that day.

c. Sales and buying orders at the market in a certain amount, in order to enable the broker to find a counter part for the orders with specific prices.

2. The market participants, part of the secret conspiracy to introduce in the market the right orders, in order to have a total amount of 70% of the bonds to be traded between these limits during that day.

Market maker broker dealer will put these orders in the market on behalf of its clients as well as in its own behalf (of proprietary trading). The scope of this operation is the creation of the targeted average market price.

After the opening of the market, the financial leverage players step in the trading. These players are part of the secret financial trust and they put in the market selling and buying orders for futures, options and warrant contracts that have market traded bonds as support assets.

The warrant is an Over-the-Counter Contract (O.T.C.) from the Pink Sheet securities segment that have the respective state bonds as support asset (T-bond or T-note).

Market maker broker dealer can wipe out with a rubber zeros from the price offers or from the quantities written on the orders received in the market from the warrant traders.

The broker can receive blank orders from the traders of warrant. In this case, the broker will fill the orders from traders with prices and quantities needed to achieve the targeted price.

Using the leverage type credit to trade the warrants on the market, the support asset price (T-notes and T-bond) can be pushed in the direction one wishes.

Some of the traders push the price up and others drop the price down to create the impression that the market is unpredictable and objective.

This way, the price will oscillate very close to the maximum limit plus minus 8% around the opening price.

If the trend has to be up for more days, then the opening price will artificially be higher than the medium price from the day before.

The trend set by the opening price is amplified after the opening of the market by the speculator traders.

If the uptrend was too much amplified by the leverage speculators, then the trend is stopped by the lower opening price than the day before.

The official explanation of the market transaction is the speculators identify an uptrend of some assets and buy cheap now to sell more expensive later.

The difference is their profit.

The same way, the profit can be made following the downtrend when traders bet the other way around thus on the falling price of the bonds.

These traders trade futures, options, warrant contracts.

If the downtrend is too fast, then the opening price of the following day will be higher, so an uptrend can be forecasted. This way will discourage the speculators that bet on falling prices.

This is the way the market price is driven by the opening price (open market price).

III. The mecanism of raising the interest rate available for state credits in order to push it to financial default

The T-bonds are issued by the state treasury and are purchased by the primary dealers, the companies that buy the bonds for the first time on the primary market.

The bonds has a value for the principal. Initial that value is equal with nominal value written in the issue prospectus.

The primary dealer can sell the bonds on the secondary market (stock exchange) if they need cash before the bonds maturity date.

During time, the value of the principle varies at the stock market according to bids and asks. If the Tehran financial sect decides a certain state has to get in default ( due to political reasons), they proceed as fallows:

– They manipulate the stock market price of the bonds principal issued by that state using the manouvers and the strategies described before for the stock market.

This way they bring the bonds principal value at a market price that is lower than the nominal value (from the date it was issued)

In this situation the primary dealer demands a higher interest rate for the new issued bonds otherwise they have better returns if they buy a lower principal bonds from the stock market.

If they still have to buy the new issued bonds, they ask during the ouction for a higher interest rate, in this way to cover the loss they suffer from buying the new issued bonds.

The loss that has to be covered by increasing the interest rate is the difference between the initial nominal value and the current market value of the bond.

Let’s assume that a bond that has another 5 year before the deadline with an interest of 4% per year, looses on the stock market 25% of the nominal values.

In this case , for the new issued bonds, the interest rate can reach 9,5% without any other risk coefficient. This is totally unsustainable for the state budget.

Resume:

The way Tehran destabilizes the government of a state that dose not allow the free capital circulation:

1. Through secret financial maneuvers of the Iranian financial trust, the market price of the state bonds crushes.

2. In order tp cover the difference between the market price and the initial nominal price of the new issued bonds, the creditors rise the interest rates.

The financial specialists know this economic rule: bond price and bond yields move in opposite directions. If the price goes down then the yield goes up.

3. The rating agencies give low rating points pretending there is no free market in that state.

These low ratings suggest the investors that the respective bonds are not recommendable for investments.

The rating agencies are founded and coordinated by the Iranian financial trust.

4. The credits that reach the deadline do not roll-over any more.

There is no creditor participates in the Finance Minister auctions for bonds.

5. The lac of currency unbalances the trade balance and over all the current account balance. (current account is external balance)

6. The national currency collapses.

7. The economic activity falls in a deep crises and unemployment rises.

8. Popular riots starts, street movements and fights are financed from abroad to replace the government.

9. A new government is installed that allow free foreign capital circulation.

IV. The targeting of the key interest rate in the U.S.A

The official pretext for the open market operation is the targeting of the key interest rate by New York Fed.

If sells T-bills, Feed extracts money from the economy and the key interest rate rises.

As a result it tampers the economy.

If they buy short term T-Bills, Fed injects money into the economy. As the amount of money offered by the banks rises, the interest rate will fall.

The economy will increase.

In reality , the real reason for open market operations is in fact te suppling of the primary dealers and further the Iranian Financial Trust with money.

The modificatino of the key interest rate has no connection with the open market operations.

The set of the key interest rate is in reality done in two steps.

For the increase of the interest rate:

Step 1. The artificial decrease of the T-note and T-bond on the stock market (medium and log term) using the stock market manouvers described before.

The decrease has to be done very carefully so the rentability calculation of the bond to deliver an interest rate equal with the key interest rate announced by Fed plus 0,25-0,30%

Step 2. The level of the interest rate offered by primary dealers in the T-note, T-bond, auctionsto be equal to the key interest rate announced by New York Fed plus 0,25%.

The auctions for this interest rate is done by secret agreement between the primary dealers and U.S. Treasury secretary that is part of the Iranian Global Trust.

Motto: Adam Smith said that in one free economy there is an invisible hand of the market that seems to regulate the course of the economy. Adam Smith seems to have missed to mention that that hand was also holding an eraser.

Will be very appropriate if Iran’s flag shows that Ayataloh with one warrant in one hand and a rubber in the other.

The Chinese (and chinese jewish) from Hong Kong, Singapore, Taiwan, Beijing, and Tibet (initiated military and financial elites) wait for the outcome of the war between Iran and the white race ( Russia – Nato).

They know about this was since 1979.

There are two camps:

1) Those who support that this is the biggest opportunity for China to benefit of the economic growth they achieved through Iran’s plan. Iran is the current leader of the Earth.

2) The ones who support the idea that the global warming is only 5% due to the CO2 emissions. The rest of 95% is due the nuclear explosions during the nuclear experiemtns. If during the Nato-Russia war 1000 nuclear bombs (1 gigaton) will explode, then the maximum summer temperature will increase by another 7 degrees C.

This will be a suicide act for the loosers, winners ans spectators.

0 Comments